Search the Community

Showing results for tags 'Tax'.

-

Hello Paul/Tyson/Cody EU Commission Information: http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/telecom/index_en.htm How to Register for and Use the VAT Mini One Stop Shop (MOSS): https://www.gov.uk/register-and-use-the-vat-mini-one-stop-shop VAT Rates by Country: http://ec.euro...

-

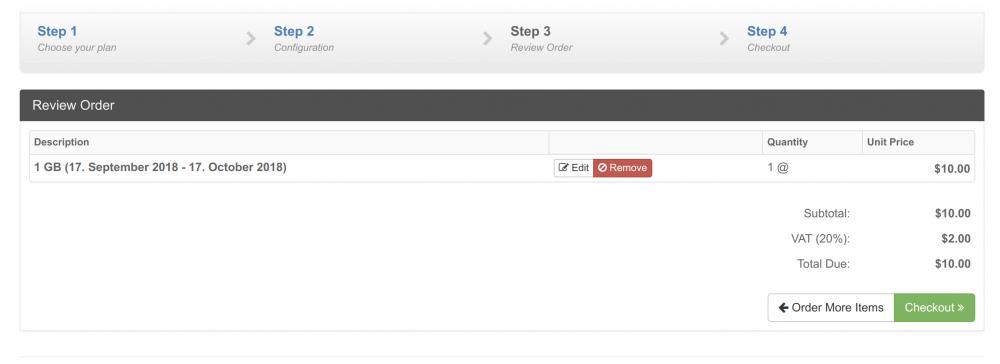

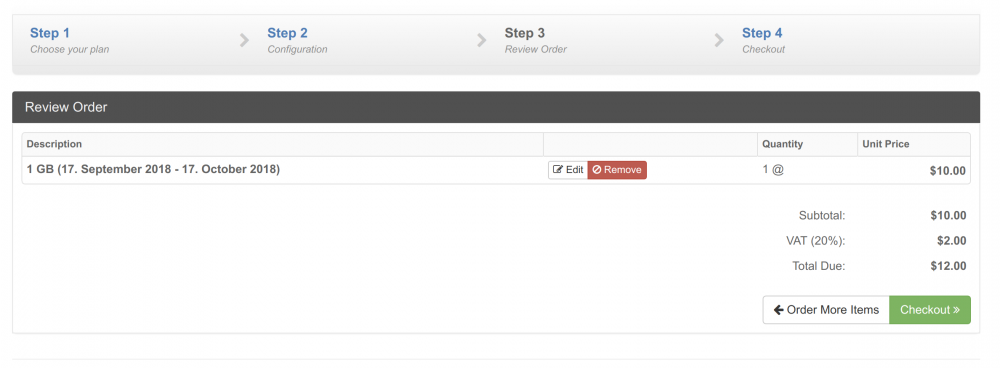

When selecting the "Inclusive" tax type, it adds the tax on top of the items subtotal price which results in a total due of $12 (instead of $10). When selecting the "Exclusive" tax type, it shows the actual Inclusive total due (also on Step 4) of $10 (instead of $12) but the Invoic...

-

I have created a coupon and gave if a 100% rate, so i can use to test services etc. i also have a tax rate of 4.5% as a processing fee, but adding the coupon only takes into account the plan rate and not the tax, so a plan at £1.50 will at a 7p tax (£1.57) but using the coupon for 100% removes t...

-

I'm having some trouble with the calculations of VAT/Sales Tax and invoice totals. For example, I have 2 line items... Line Item 1 -- Quantity 3 -- Unit Price 32.50 -- Cost 97.50 Line Item 2 -- Quantity 3 -- Unit Price 32.50 -- Cost 97.50 Subtotal: 195.00 VAT @ 23.0000%: 44.86 Total:...